There are lots of reasons for adding solar to your home or business:

- lowering your energy costs

- reducing your carbon foot print

- having power where the utility isn’t available

- mitigating carbon based taxes

- generating your own power

- increasing property value

The most common goals are having smaller electric bills and minimizing one’s impact on the environment. Here are some ways to recover the cost of going solar along with potential benefits.

Federal Tax Credit

When you purchase a solar photovoltaic (PV) system, you are eligible for the Investment Tax Credit known as the Residential Clean Energy Credit that you can claim on your federal income taxes for a percentage of the cost of the system.

In 2021, the Investment Tax Credit (ITC) provided a 26% tax credit for systems installed between 2020 through 2022. The ITC will now provide 30% for systems installed in tax years 2022 through 2032

To qualify for the 30% federal tax credit, your solar system needs to be installed and deemed operation by a city inspector in any of the tax years 2022-2032. The 30% credit applies retroactively to systems installed in 2022 when the credit was still at 26%.

The Residential Clean Energy Credit is a dollar-for-dollar tax credit worth 30% of the total cost of solar and/or battery storage expenditures. It’s essential to note that you can only claim the credit once. The credit is a deduction, not a refund. As a non-refundable tax credit, it lowers your tax liability on your federal tax return. If you do not have sufficient tax liability, the tax credit can be rolled over into future years.

What Does the Federal Solar Tax Credit Cover?

If you are a homeowner that recently installed a solar panel system in 2023, you are eligible to claim a federal tax credit that covers 30% of the following:

- Solar panels cost;

- Solar equipment costs like inverters, wiring and mounting hardware;

- Labor costs for solar panel installation, including fees related to permitting and inspections;

- Solar power storage equipment costs like solar batteries. Storage devices must have a capacity rating of at least 3 kilowatt-hours (kWh).

Contact us for more information on incentives or visit: www.dsireusa.org

Washington Solar Sales Tax Exemption

As of July 1, 2019, all solar equipment for systems less than 100 kW is exempt from state and local sales and use taxes. This tax exemption is good through December of 2029 and can often save solar buyers thousands of dollars!

Financing Available

We have developed a partnership with credit unions in Washington State that can help with financing Residential Solar Projects at low interest rates.

- $0 to get started, you can finance 100% of the project cost.

- Low interest rates, with rates as low as 4.50% Maximum loan limit of $65,000.

- You determine the loan term up to 180 months (15 years), with no prepayment penalty.

- You may re-amortize the loan once at no cost. This is a great way to reduce the loan payments by paying down the loan using money from your federal tax credit, first year of production payments, or both.

- This is NOT a home equity loan. The loan is secured against the solar equipment, not your home.

How is Solar Making an Environmental Difference?

We have installed over 1MW of solar modules and are closing in on our second Megawatt!

According to the EPA’s Greenhouse Gas Equivalencies Calculator, the average daily amount of power produced from our installs is equivalent to:

| 3 Tons of CO2 Gas (Averted) | Greenhouse Gas Emissions from Driving a Typical Car 6567 Miles | CO2 Emissions from Using 301 Gallons of Gas | Carbon Sequestered by 3.2 Acres of U.S. Forrest in 1 Year |

|---|

Click the link above and enter the number of kWh from your last electric bill.

Make sure to select “kilowatt-hours of electricity” from the ‘-choose a unit-‘ menu.

Select Calculate to see what impact your electrical use has and then give us a call to learn how solar may benefit you and the environment!

Let’s see How these Credits & Tax Exemptions make a difference with this Sample Home

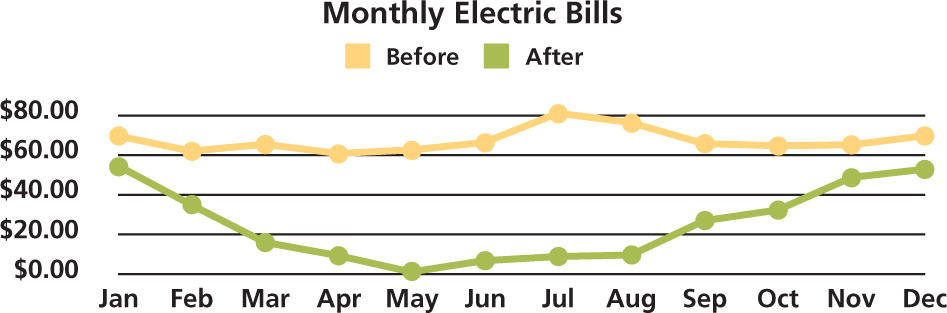

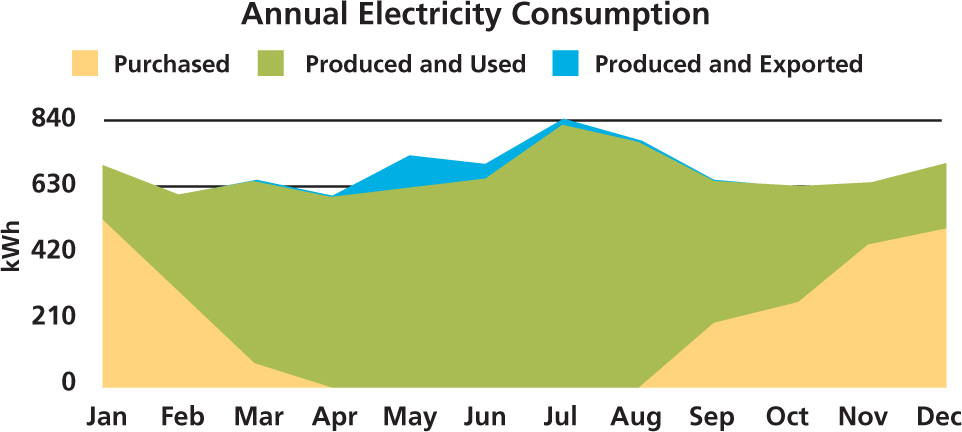

This sample home is using 675kWh per month. Here is how going solar provides the benefits of reduced electrical bills and a decreased carbon footprint.

Currently a home owner could have up to 30% of the cost of a solar PV system returned by means of the Federal Tax Credit. The sales tax exemption in Washington provides another cost savings to the overall system.

- System size and cost: 4.8 kW System for $13,200.00

- Average monthly Utility bill before adding solar: $66.17

- Average monthly Utility bill after adding solar: $24.75

- A 30% Federal Tax Credit : $3,960.00

- Property value increase: $10,235.00

Free Consultations

PCI Renewables uses state of the art solar site analysis tools and years of experience to evaluate your site for potential solar energy production. We offer site investigations consultations and estimates. All proposals provide you with estimates for any variety of system sizes and products you request, estimated production values based on site analysis and solar installation values and simple payback economic analysis. All for free with no obligation!

Give us a call at (509) 838-2527 to get your consultation & estimate